About Us

About Rebate

My Tax

About Us

About Rebate

My Tax

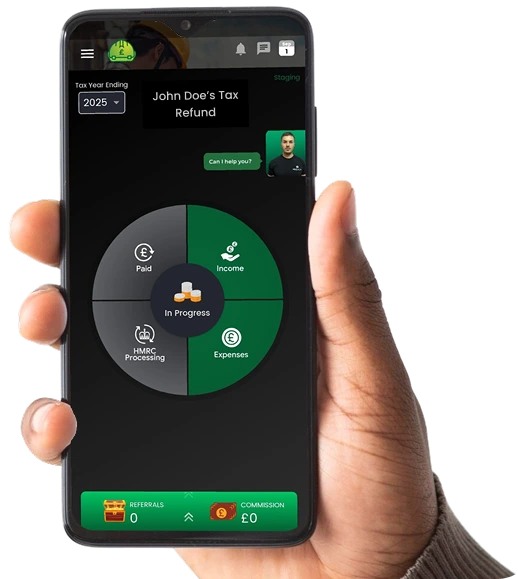

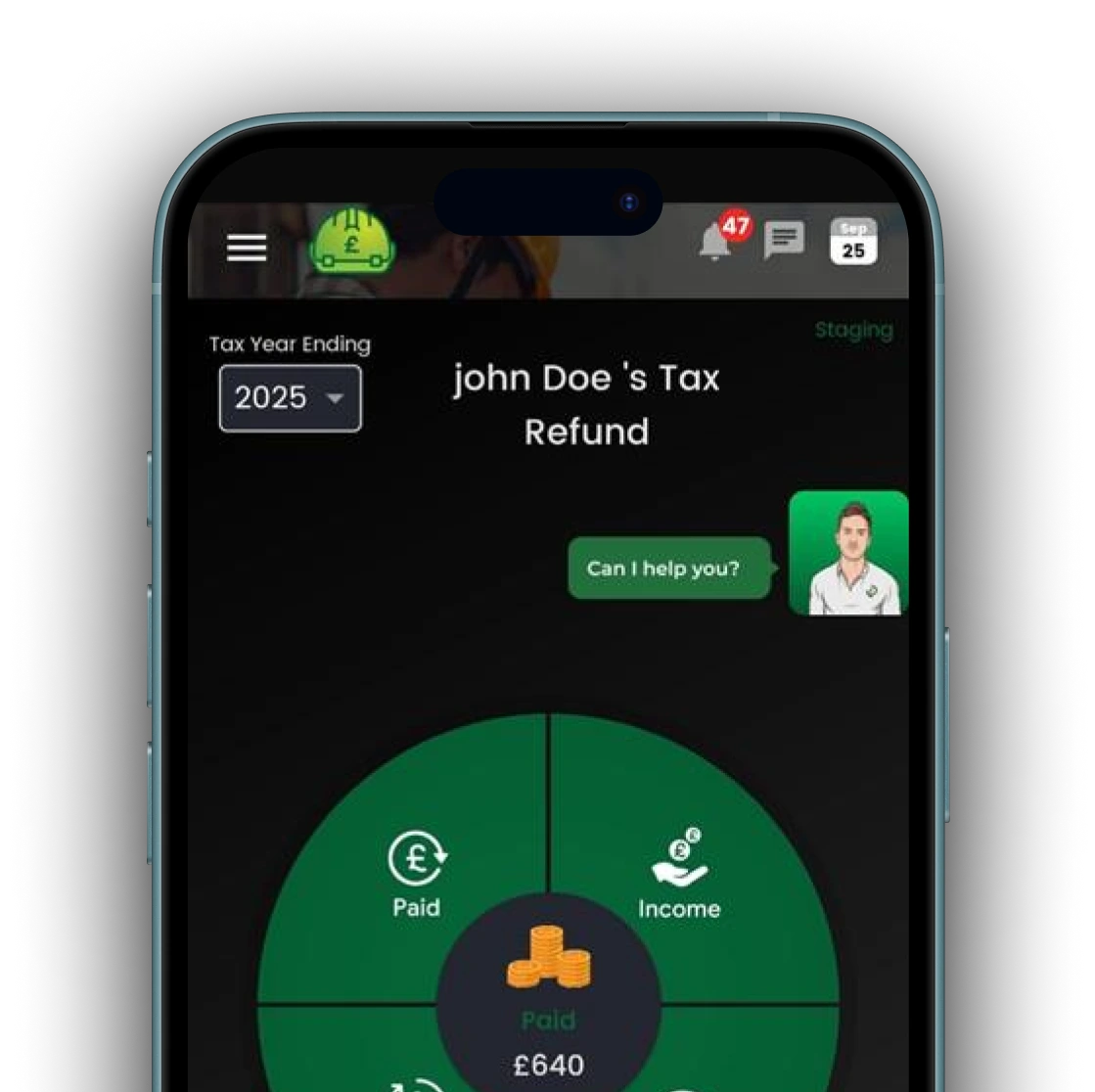

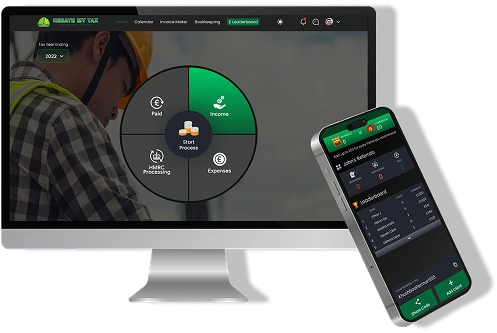

Rebate My Tax is a modern, digital-first tax and accounting firm helping individuals and businesses manage their finances simply and confidently. Through our secure app and expert in-house team, we streamline everything from tax returns and compliance to ongoing accounting support - removing the hassle, paperwork, and confusion of traditional accountants.

Our technology-led approach gives you clarity, control, and real-time visibility, while our experienced professionals ensure everything is accurate, compliant, and handled properly.

-

All-in-One Digital App

-

Real Experts Behind the Tech

-

Simple, Stress-Free Service

Our Services

Tax & Accounting for Individuals & Businesses

Our Process

How We Work

Get Started

Download our free app, sign up securely, and get instant access to your personalised tax dashboard.

Connect & Share

Link your bank, add any supporting documents, and answer a few simple questions - our technology does the heavy lifting.

We Take It From Here

Our expert team reviews everything, completes the work, and keeps you updated - simple, compliant, and stress-free.

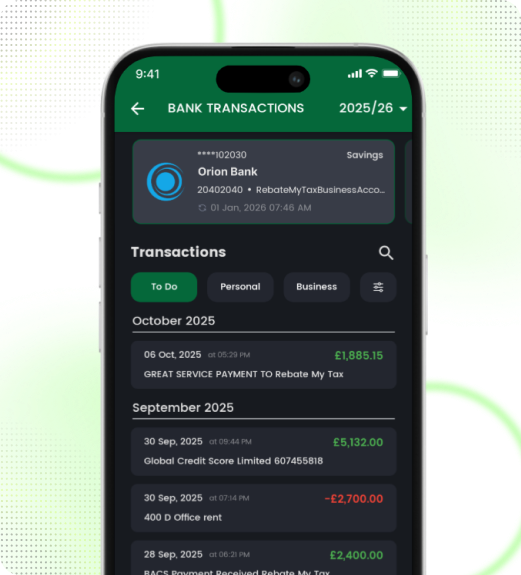

Secure & Automated Bank Sync via Open Banking.

Secure & Automated Bank Sync via Open Banking.

Automatically sync your bank transactions in real time through a secure, read-only connection - no paperwork, no uploads, no hassle.

-

Bank-grade security, read-only access

-

No statements or spreadsheets required

-

Live, accurate financial data - always up to date

Why Choose

Rebate My Tax

Digital-First Tax & Accounting

All your tax and accounting managed through one secure app - no paperwork, no chasing.

Self-Employed & Landlord Specialists

Dedicated support for sole traders, landlords, and CIS subcontractors - ensuring accurate reporting, full HMRC compliance, and peace of mind.

Fast, Efficient Turnaround

Our streamlined digital process allows us to act quickly without compromising on accuracy or quality.

Direct Expert Support

Real accountants and tax professionals available when you need advice or clarity - not chatbots.

Clear, Transparent Pricing

No hidden fees or surprises. You’ll always know exactly what you’re paying for.

We Handle Everything

From submissions to compliance, we take care of the details so you can focus on your business.

Download the Rebate My Tax App

Fast, secure, and simple tax and accounting - all managed in one powerful app, wherever you are.

Testimonials

What our clients say

Recent Articles

Your go-to source for tax updates, guides, and smart financial tips.

Comparing sole trader vs limited company in 2026? Learn the tax differences, profit thresholds and which structure could save you more.

Working from home in 2026? Learn what HMRC allows you to claim, flat rates vs actual costs, and how to avoid penalties under Making Tax Digital.

From April 2026, HMRC’s Making Tax Digital (MTD) rules will apply to millions of sole traders and landlords across the UK.

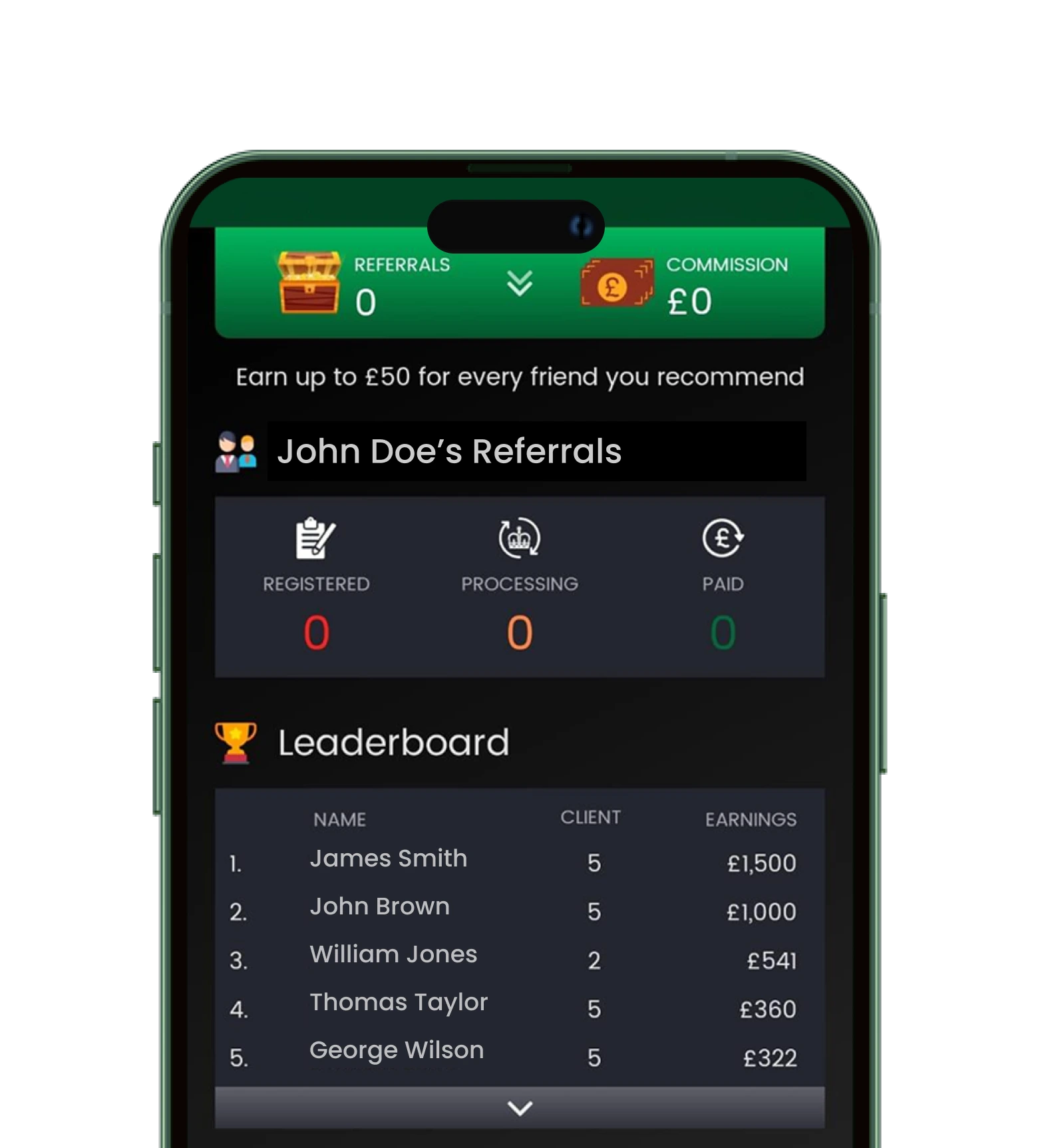

Refer & Earn £50

Invite your friend to download the Rebate My Tax app & create an account. Once your friend uses our services to deal with their tax returns, you’ll earn £50! Ker-ching!

AWARDS &

RECOGNITION

PROUDLY RECOGNISED FOR EXCELLENCE IN TAX, ACCOUNTING, AND DIGITAL SERVICE DELIVERY.

SME500 UK - 2025 Awards.

Best Accounting Company of 2025

Global 100:

Best Accounting Company of 2025 & 2026

M&A Today - Global Awards 2025:

Best Accounting Company of 2025

M&A Today - Global Awards 2026:

Best Accounting Company of 2026